The excitement around Gem Aromatics’ IPO isn’t dying down. The company, best known for making aromatic ingredients used in products like cosmetics and wellness goods, has seen big demand since opening its public issue on August 19.

According to websites that track unlisted shares, the grey market premium (GMP) for Gem Aromatics is currently between ₹26 and ₹36. With the upper estimate at ₹36, Gem Aromatics looks set for a lively stock market debut and could list at around ₹361 per share, over 11% above its IPO price.

Strong Subscription Numbers on Day 2

On the second day of bidding, investors remained interested in grabbing a piece of this speciality chemicals maker. The IPO had been subscribed to 1.61 times in total by early afternoon, with bids in every investor category.

- Retail investors have applied for over 9.1 million shares against 4.95 million reserved for them (subscribed 1.84 times).

- Non-institutional investors (Nils) showed strong interest too, bidding for over 3,4 million shares versus 2.12 million available (subscribed 1.62 times).

- Qualified Institutional Buyers (QIBs) placed bids for 3.1 million shares, about 1.17 times their total allotted lot.

IPO Details

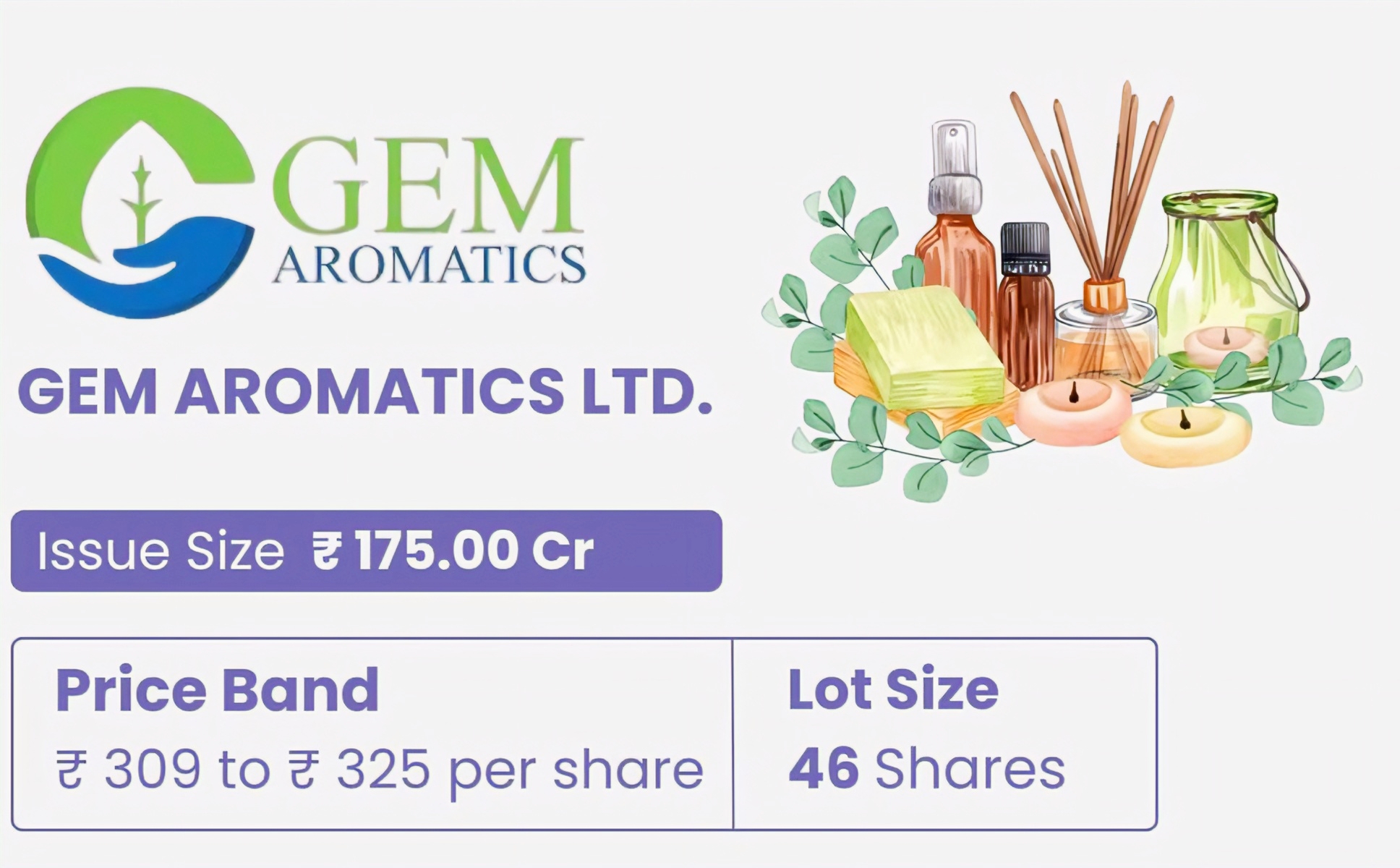

- Total Offer Size: ₹ 451.25 crore.

- Fresh Issue: 5.4 million shares, raising ₹175 crore.

- Offer for Sale: 8.5 million shares, collecting ₹276.25 crore,

- Price Band: ₹309-325 per share.

- Minimum Bid: 46 shares (investment of about ₹14,950).

If you want to apply, the subscription window closes on August 21. Share allotment will be finalised on August 22, with refunds and credit of shares scheduled for August 25. The company’s shares are expected to list on both the NSE and BSE by August 26.

Strong Financials

Gem Aromatics has shown steady financial growth. For the year ending March 2025, they clocked a total income of ₹505.64 crore, an increase of more than 11% compared to ₹454.23 crore last year. Net profit also grew to ₹53.38 crore from ₹50.1 crore, marking a 6.5% annual jump.

Promoters and Management

The main promoters are Vipul Parekh, Kaksha Vipul Parekh, Yash Vipul Parekh, and the Parekh Family Trust. Their stake will go from 75% pre-issue down to about 55% post-listing.

Motilal Oswal Investment Advisors is managing the IPO, with Kfin Technologies handling the registrar duties.

Where’s the Money Going?

Gem Aromatics plans to use the funds from its IPO to pay off part of its debts and for general business needs. The company’s speciality ingredients end up in everything from toothpaste and pain relief creams to wellness and personal care products.

Founded back in October 1997, Gem Aromatics has become a major name in high-value chemical ingredients, providing essential components to sectors like healthcare, beauty, and nutrition.